Warning Signs of Tax Refund Fraud & What To Do About It

Tax related identity theft occurs when someone uses another person’s social security number to claim a tax refund from the IRS by filing tax returns early in the tax-filing season. The IRS estimated that it prevented $24.2 billion in fraudulent identity theft refunds in 2013 but they paid out $5.8 billion in refunds that were later determined to be fraudulent. In a January 2015 Identity Theft and Tax Fraud Report, they admitted these numbers were likely underestimated due to their inability to accurately include fraud that had not yet been identified!

Tax related identity theft occurs when someone uses another person’s social security number to claim a tax refund from the IRS by filing tax returns early in the tax-filing season. The IRS estimated that it prevented $24.2 billion in fraudulent identity theft refunds in 2013 but they paid out $5.8 billion in refunds that were later determined to be fraudulent. In a January 2015 Identity Theft and Tax Fraud Report, they admitted these numbers were likely underestimated due to their inability to accurately include fraud that had not yet been identified!

This tax season, different events led to three of my friends discovering their children had become victims of tax fraud. A 21-year-old college student who had not earned a salary received a letter from the IRS for an amended tax return. An employed 24-year-old who had not yet filed his tax return received a letter from the IRS requesting additional information for a 2014 tax return. A 23-year-old who had not yet filed her tax return received a $4,700.00 refund check. These three were lucky to be alerted to the problem in a timely manner by mistake but fraud like this can cause horrendous damage when it goes undetected for a long time, especially in the case of identity theft involving social security numbers of young children.

Clues pointing to tax identity fraud:

For purposes of this article, references to “you” or “your” can be replaced by any family member.

- You discover someone filed taxes with your social security number when you try to file them yourself.

- You’re alerted to a problem with your credit report by an entity that you’ve authorized to run a credit report on you. (A family member became aware of tax fraud when he attempted to refinance a property.)

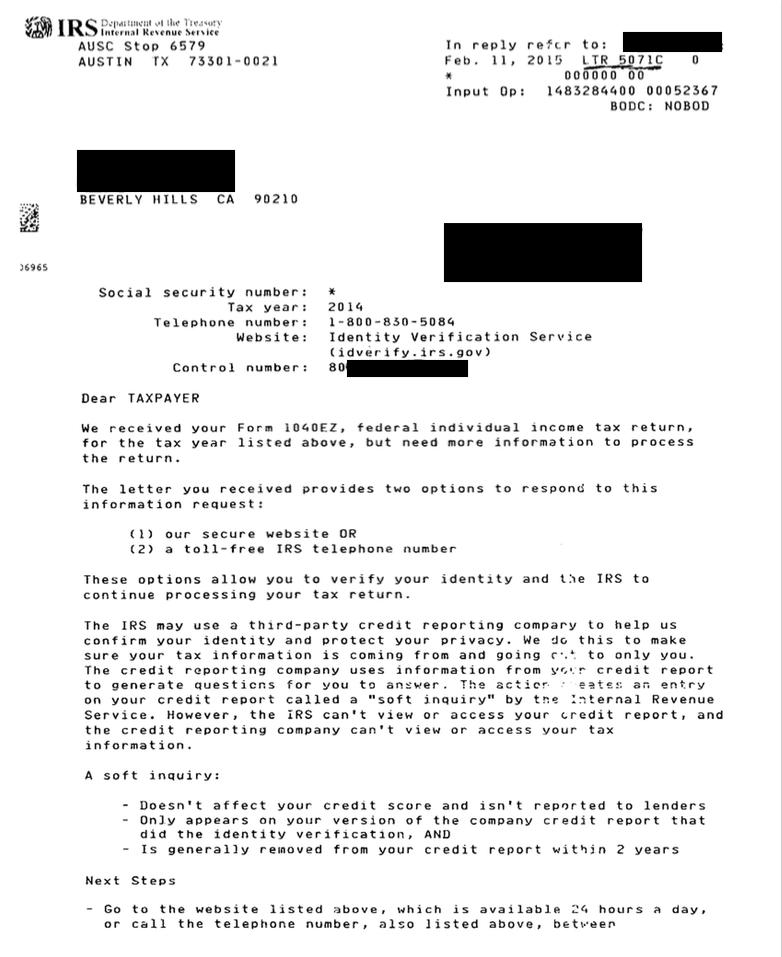

- You receive communication from the IRS regarding tax returns you did not file. They may request additional information or they may send you a 5071C Letter asking you to verify your identity. (see letter received by 21-year-old college student below)

This letter from the IRS is what lead to discovery of tax fraud for a student who had not filed taxes because he had no income.

- The IRS notifies you that you received wages you did not earn.

- Your social security benefits are denied or amended due to revenue you didn’t receive.

- Your Social Security Administration “Notice of Earnings” lists more income than you’ve earned.

- You receive a 1099 or W-2 from an employer you did not work for.

- You receive a tax refund but you have not yet filed your taxes.

- In the case of my friend’s daughter, the criminal(s) intended for the $4,700.00 refund to be direct deposited to an account but the direct deposit account was set up incorrectly. If the first direct deposit attempt fails, the IRS sends a paper check via postal mail instead.

Seven (7) Steps to Take if you Suspect Tax Related Identity Theft (pertaining to you or a family member)

1. Place a fraud alert or a credit freeze on credit reports (use links below) with one of the credit bureaus and confirm that bureau will notify the other two.

o Experian: 888-397-3742 Place Fraud Alert or Place a Security Freeze

o TransUnion: 800-680-7289 Place a Fraud Alert or Place a Security Freeze

o Equifax: 888-766-0008 Place a Fraud Alert or Place a Security Freeze

A “fraud alert” identifies an individual as a fraud victim and requests that the business obtaining the report contact that person before granting credit in that name. (It lasts for 7 years or for less time, if removed sooner.)

A “credit freeze” prevents anyone from accessing a specific credit history. (A PIN is required to access that credit history and the credit file must be unfrozen before applying for credit or other services that require accessing that credit history.)

2. File a police report with your local police department.

3. File a complaint with the Federal Trade Commission.

4. Close all financial accounts that were tampered with or opened without you.

5. Respond to official IRS notices but verify the information is authentic first.

6. Complete IRS Form 14039, Identity Theft Affidavit.

7. Check all bank accounts frequently to make sure there are no fraudulent transactions in any of them.

The 23-year-old who received the refund check previously used TurboTax and TurboTax experienced a breach that may be the source of the fraudulent tax refund she received. TurboTax is providing victims with free credit monitoring services and will also pay other fraud related fees (such as fees for freezing and unfreezing credit, if there are any). As an Anthem breach potential victim, I’m taking advantage of free credit monitoring services although I caution people to place full trust in these services as they are unable to detect and identify all forms of fraud. There is no substitute for being vigilant and frequently checking all financial accounts. That said, one of the advantages of using such a service is some of the plans include follow up and handling of different aspects of fraud, including reaching out to the IRS via a special phone number on behalf of victims. My friend who recently reached out to the IRS on behalf of her son told me an IRS recorded message stated phone assistance was not available for victims during the peak of the tax filing season.

I will end by reminding you that prevention is so much better than cure! However, if you or a family member do not have the luxury of prevention, the next best option is to identify the problem as soon as possible and to promptly follow the important steps listed in this article to limit the potential damage that could easily occur.

Until next time, … Stay Cyber Safe!

Leave a Reply

Want to join the discussion?Feel free to contribute!